Knowledge Base

Knowledge Base

Financial Investment

Definition of Usufruct

Usufruct: In a Nutshell it Means

Bare ownership is nothing more than the value of the deprived property only of the right of usufruct which can be for life or for life.

This means that with bare ownership, you buy a property, but allowing those who probably already live there to live in it, which is usually the owner of the house who has just sold you bare ownership of it. The person who retains the usufruct therefore retains the right to remain there for life.

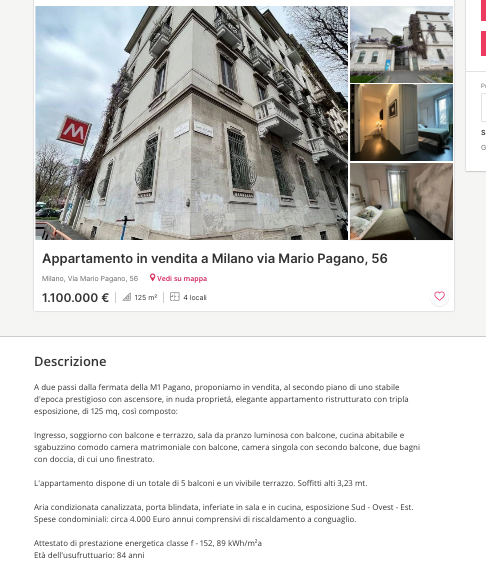

source : www.gabetti.it

Why Buy a House in Usufruct?

A medium-long term investment that is safer, more profitable and more competitive than many others

- the initial investment is contained since you buy the property at a much lower price

- the investment is revalued doubly: increase in the market value of the property and advancement of the age of the usufructuary. So whoever buys puts his savings in the “best safe in the world”!

- bare ownership can be resold at any time and always revalued

- you are entitled to tax breaks (first home and taxes calculated on reduced tax values), you do not pay IMU and TARI or condominium expenses or ordinary maintenance (to be paid by the usufructuary)

Practical example

- Let’s say you buy a €300,000 apartment from a 75-year-old owner.

- According to the tables of the Revenue Agency, the payment is agreed with a 35% discount, therefore €195,000.

- Suppose that after 12 years you are no longer willing to wait for the usufruct to expire while the usufructuary has reached the age of 87. So you decide to resell your property.

- Then you will be able to resell it, even assuming that the property has not revalued on its behalf and therefore its value net of inflation will always remain the same.

- then, based on the usufruct evaluation tables, you can resell it at a 15% discount or at the price of 255,000.

- Then you will be able to calculate how much you have earned: you have invested €195,000, you have resold it for €255,000 with a surplus value of €60,000 which corresponds to a 30% higher yield which corresponds to an annual rate of 2.6%.

- How much would you have earned with BOTs?

source: www.luxuryvillaitaly.com

Market Statistics

Who Sells

81.1% of those who sellFrom the Tecnocasa and Tecnorete affiliated agencies, it appears that they do it to raise liquidity, to maintain a certain standard of living, or to meet needs related to advancing age and sometimes to support their children in buying a house.

62.2% of those who sellare over 65 years of age.

57.6% of those who sellhey are single, widowed, divorced or separated.

Who Buys

81.8% of those who buycarries out the operation as a long-term investment, while the remaining part does so with the intention of securing a main residence at a more advantageous price.

74.5% of those who buyIn 2021, 74.5% of bare ownership sales were aimed at long-term investment. This is a growing percentage compared to 2019 but slightly down compared to 2020. In fact, bare ownership allows you to buy the property at a lower price than the market price.

67.3% of those who buyThey are couples without children or with children and 43.2% choose three-room apartments and 21.6% choose four-room apartments

42.5% of those who buyThe most sold type with the formula of bare ownership is the three-room apartment with 42.5% of preferences.

32.7% of those who buyThey are single.

32.4% of those who buyare aged between 35 and 44, while the percentages of purchases by the under 35s and over 65s are low.

26.3% of those who buythey are between 45 and 54 years of age.

26.3% of those who buythey have children. In fact, parents often buy bare ownership and then give it to their children.

25% of those who buycome, a treasure to supplement their retirement.

24.3% of those who buyBuyers between the ages of 45 and 54 are in second place among buyers

21.6% of those who buythose between 55 and 64 years of age are placed.

13.5% of those who buyè over 65. Sono coppie e coppie con figli.

8,1% di chi compraThey are over 65. They are couples and couples with children.

Typologies of sales

43.2% of saleshey are three-room apartments

21.6% of salesthere are 4 rooms

16.2% of salesThey are two-room apartments

10.8% of salesthey are independent or semi-independent properties In 2021, independent sales amounted to 10.8% of the total, a decrease compared to 2020 but an increase compared to 2019 when, in the first part of the year, they stopped at 7.0%.

8.1% of salesthey are made up of five rooms

How they are purchased

86.5% of paymentsit was proceeded directly in cash. Compared to the past, therefore, less recourse is made to a mortgage for the purchase of bare ownership.

13.5% of paymentsoccurred with the help of a mortgage loan

Where the trades were made

- Lombardy, with 1,916 properties

- Lazio (1,216)

- Veneto (1,117)

- Piedmont (706)

- Tuscany (434).

Trend

- Rif. www.wallstreetitalia.com

- Rif. www.gazzettadellalombardia.com

- Rif. patrimoniefinanza.com

- Rif. mutui.segugio.it

Market Trends

In recent years there has been an increase in the sale and purchase of bare properties, historically favored by the economic crisis which has affected the real estate market and access to credit in general and by the progressive aging of the Italian population which, together with a difficult labor market entry for young people, has in particular oriented family decisions towards the idea of transferring in advance the bare ownership of one’s own (or new) property to the children, maintaining the right to live there until one’s death.

Source. www.altalex.com

Double the requests

The increase in visits relating to the “bare ownership” typology in April 2020 translated into a doubling in the level of requests compared to the previous period, with a peak in February 2022.

Source.: www.wallstreetitalia.com

How to calculate usufruct?

- You start from the appraisal value of the property

- The current legal interest rate established by the Ministry of Finance is considered. From January 2023 it is 5%

- The percentage of the usufruct relating to the age group of the usufructuary (the owner who sells) is applied, which is progressively lower as the age of the usufructuary advances (the older the age, the higher the price).

- Multiply this percentage by the valuation price of the property.

In the table below there is a real case for a €250,000 property.

We have added a fourth column which takes into account life expectancy (currently estimated at between 85-87 years), the convenience of looking for a property sold by a ustructuary within a certain age range and the minimization of the risk of keeping the investment blocked for too long time by exploiting the possibility of reselling it before the expiry of the usufruct, protecting oneself from various risks including, mainly, a deterioration of the property, and rising inflation, etc. etc.

This table shows that the best compromise is a purchase from a usufructuary aged between 73 and 82 years.

Value confirmed by the market analysis made by the most active real estate agencies in the sale of bare ownership.

| Usufructuary age ranges | Usufruct percentage | property case € 250K | savings | Convenience |

| 0 – 20 | 95% | 12,500.00 | 237,500.00 | Nothing |

| 21 – 30 | 90% | 25,000.00 | 225,000.00 | Nothing |

| 31 – 40 | 85% | 37,500.00 | 212,500.00 | Nothing |

| 41 – 45 | 80% | 50,000.00 | 200,000.00 | Nothing |

| 46 – 50 | 75% | 62,500.00 | 187,500.00 | Nothing |

| 51 – 53 | 70% | 75,000.00 | 175,000.00 | Low |

| 54 – 56 | 65% | 87,500.00 | 162,500.00 | Low |

| 57 – 60 | 60% | 100,000.00 | 150,000.00 | Low |

| 61 – 63 | 55% | 112,500.00 | 137,500.00 | Low |

| 64 – 66 | 50% | 125,000.00 | 125,000.00 | Low |

| 67 – 69 | 45% | 137,500.00 | 112,500.00 | Low |

| 70 – 72 | 40% | 150,000.00 | 100,000.00 | Low |

| 73 – 75 | 35% | 162,500.00 | 87,500.00 | high |

| 76 – 78 | 30% | 175,000.00 | 75,000.00 | high |

| 79 – 82 | 25% | 187,500.00 | 62,500.00 | high |

| 83 – 86 | 20% | 200,000.00 | 50,000.00 | Low |

| 87 – 92 | 15% | 212,500.00 | 37,500.00 | Low |

| 93 – 99 | 10% | 225,000.00 | 25,000.00 | Low |

Basically, if I buy an apartment for €250,000 from a 74-year-old owner, I pay €162,500.

If I resell it 5 years later (the usufructuary will be 79 years old) I can resell it for €187,000 with a net proceeds of €24,500 which corresponds to a return greater than the 15% made in 5 years, therefore equal to an average annual return of 5%.

Source: patrimoniefinanza.com

PROS/CONS for those who buy

PRO

you can have a property at a cheaper price than other properties of the same type and size on the market, which you can use in the future or donate to your children

The usufructuary has the obligation to keep the property in excellent condition, guaranteeing effective maintenance

The value of the property grows steadily over time and therefore you can resell it before the end of the usufruct while still guaranteeing an unbeatable investment.

Contro

Not all banks grant loan mortgages, so you need to find the right one or have the whole amount available or reach an agreement for an installment payment with the seller. This is because the banks consider bare ownership an investment and not a purchase of a property to be used immediately.

PROS/CONS For Who Sells

- An option for the future as a complement to retirement. Most real estate experts point out that the sale of bare ownership is an option especially among those between 65 and 70 years old and looking for a supplement to their retirement. It is one of the best ways to obtain liquidity on an illiquid asset such as a house without giving up its use and enjoyment until death. That is to say, for many people the sale of bare ownership predominantly confers benefits to their daily lives.

- The heirs of the usufructuary who transfers the property will not be able to dispose of it, since the property becomes the property of whoever has the bare ownership.

The Case of Forthcoming Future Retirees

- I want to find a new, smaller house, suitable for us without children, with less expensive maintenance and a condominium

- I have to reduce the daily cleaning work that my wife and I will eventually have to do, albeit with the help of an hourly lady

- I need to arrange some cash (liquidation, for example) to balance my children’s inheritance

- I have to find a home

- in a city close to at least one of my children but more livable. For example a city between 50,000-300,000 inhabitants.

- it must be just outside the historic center to avoid parking problems and close, but not too close to a road

- close to supermarkets and shopping centers to be reached on foot or by bicycle

- all services at a maximum distance of 2-3 kilometers to be reached on foot or by bicycle

- very green

- nearby bus/metro stops maximum 300 meters.

- guest parking

- exposure: east/south with at least 2 sides

- energy class good for energy saving

- rather low condominium installment

- garage

- surface area 120-150 m2

- two bathrooms

The Case of Investment for Children

- at least one child under the age of 10

- possess a degree and who considers education indispensable for a professional affirmation

- own a home that is adequate for his income and standard of living

- have an above-average family income to be able to afford to pay a mortgage or an adequate saving capacity having an interesting liquidity, perhaps coming from a newly received inheritance.

- Having identified a university (and therefore a city) compatible with the predispositions of the child/children

- Having identified the characteristics of a property for a single person (the child) or a couple (premarital) therefore a floor area between 50-100 square meters.

- Having located the city, the area, the location of the property that has public transport within walking distance (maximum 300 meters)

- condominium installments, maintenance costs, etc. quite contained

- Possibly that the property will revalue within the next 10 years on the basis of the master plan of the area or the location of neighboring commercial (or residential) areas under construction, therefore anticipating the building boom which will take place within a maximum of 10 years

- Services, offices, schools, universities, shopping centres, junctions within a radius of less than 2 km.

- garage, cellar, box which acquire more significant commercial value

The Case of Treasure Chest for Old Age

This category includes those who have a certain amount of liquidity available who want to invest in a safe way not believing in stock speculation (stock market, bot) and intend to diversify (therefore not within their own business area such as a private company).

Therefore it is an investment to avoid leaving them in the bank’s safety deposit box or directly on your current account.

Those people who are not too convinced about investing in the securities market (government bonds, stock exchanges, bonds, gold, etc.), are afraid to invest in the real estate market because renting is no longer convenient due to taxes, expenses and the risk of not being paid or of incurring legal disputes due to the tenant’s negligence.

The best idea would be to give it to someone who you are sure is very shrewd – as if it were his own – who really has an interest – and has the disposition – to keep it in excellent condition and therefore who can deal with the ordinary expenses and ordinary maintenance while preserving the net return on investment.

Therefore, the real estate investment must be easily monetisable, even in an emergency, and in any case the yield remains almost preserved thanks to its objective commercial revaluation to mitigate the risk of selling off in an emergency.

So the optimal property could be

- provide for the demobilization of the investment between 7 and 15 years (usufruct)

- reliable tenant

- condominium with centralized services

- box, cellar, garage, parking space because they enhance the property

- surface area between 70 and 110 m2

- excellent position

- condition of the property in excellent condition

- verification of the revaluation of the area and of the property

The Case of Pure Financial Speculation

- evaluate the term of the annuity usufruct based on the life expectancy of the usufructuary

- anticipate the sale of bare ownership

The Case of Far-Sighted Young People

- the monthly saving capacity

- the time forecast in which he will have to choose his “stable accommodation”

- The amount of immediate liquidity available

Supply and Demand Market

How the Real Estate Agencies Oversee the Provinces

| Region | Province | Agenzia/ Franchising |

| Abruzzo | Chieti | |

| L’Aquila | ||

| Pescara | ||

| Teramo | ||

| Basilicata | Matera | |

| Potenza | ||

| Calabria | Catanzaro | |

| Cosenza | ||

| Croton | ||

| Reggio Calabria | ||

| Vibo Valentia | ||

| Campania | Avellino | |

| Benevento | ||

| Caserta | ||

| Naples | ||

| Salerno | ||

| Emilia Romagna | Bologna | |

| Ferrara | ||

| Forlì-Cesena | ||

| Modena | ||

| Parma | ||

| Piacenza | ||

| Ravenna | ||

| Reggio Emilia | ||

| Rimini | ||

| Friuli Venezia Giulia | Gorizia | |

| Pordenone | ||

| Trieste | ||

| Udine | ||

| Lazio | Frosinone | |

| Latin | ||

| Rieti | ||

| Rome | ||

| Viterbo | ||

| Liguria | Genoa | |

| Imperia | ||

| La Spezia | ||

| Savona | ||

| Lombardy | Bergamo | |

| Brescia | ||

| Como | ||

| Cremona | ||

| Lecco | ||

| Lodi | ||

| Mantua | ||

| Milan | Preatoni Casanuda | |

| Monza and Brianza | Mister House | |

| Pavia | ||

| Sondrio | ||

| Varese | ||

| Marche | Ancona | |

| Ascoli Piceno | ||

| Fermo | ||

| Macerata | ||

| Pesaro and Urbino | ||

| Molise | Campobasso | |

| Isernia | ||

| Piedmont | Alexandria | |

| Asti | ||

| Biella | ||

| Cuneo | ||

| Novara | ||

| Turin | ||

| Verbano-Cusio-Ossola | ||

| Vercelli | ||

| Puglia | Bari | |

| Barletta-Andria-Trani | ||

| Brindisi | ||

| Foggia | ||

| Lecce | ||

| Tarentum | ||

| Sardinia | Cagliari | |

| Carbonia-Iglesias | ||

| Medio Campidano | ||

| Nuoro | ||

| Ogliastra | ||

| Olbia-Tempio | ||

| Oristano | ||

| Sassari | ||

| Sicily | Agrigento | |

| Caltanissetta | ||

| Catania | ||

| Enna | ||

| Messina | ||

| Palermo | ||

| Ragusa | ||

| Syracuse | ||

| Trapani | ||

| Tuscany | Arezzo | Tecnorete |

| Florence | Tecnocasa | |

| Grosseto | Tecnocasa | |

| Livorno | Tecnorete | |

| Lucca | Tecnocasa | |

| Massa-Carrara | Tecnorete | |

| Pisa | Tecnorete | |

| Pistoia | Tecnocasa | |

| Lawn | Tecnocasa | |

| Siena | Tecnocasa | |

| Trentino Alto Adige | Bolzano/ Bozen | |

| Trent | ||

| Umbria | Perugia | |

| Terni | ||

| Valle d’Aosta | Valle d’Aosta/ Vallée d’Aoste | |

| Veneto | Belluno | |

| Padua | ||

| Rovigo | ||

| Treviso | ||

| Venice | ||

| Verona | \ | |

| Vicenza |

Top Ten Barely Owned Franchises

| Franchising | Total Agencies | Province most attended |

| tecnorete.it/ | 521 | |

| tecnocasa.it | 1.747 | |

| gabetti.it | 1.188 | |

| kiron.it | 206 | |

| Likecasa.it | ||

| maguranoimmobiliare.it | ||

| gruppoilsestante.it | ||

| idealista.it | ||

| agenzie-immobiliari.eurekasa.it | ||

| wikicasa.it | ||

| sicasaimmobiliare.com |

The most livable Italian cities in 2022

| Position | Province | Score | Position on 2022 |

| 1 | Bologna | 590,28 | 5 |

| 2 | Bozen | 585,73 | 3 |

| 3 | Florence | 581,86 | 8 |

| 4 | Siena | 578,52 | 11 |

| 5 | Trent | 576,62 | -2 |

| 6 | Aosta | 575,38 | -2 |

| 7 | Trieste | 574,35 | -6 |

| 8 | Milan | 573,94 | -6 |

| 9 | Parma | 573,82 | 3 |

| 10 | Pisa | 567,93 | 12 |

| 11 | Cremona | 562,69 | 26 |

| 12 | Udine | 561,95 | -3 |

| 13 | Reggio Emilia | 561,62 | 6 |

| 14 | Bergamo | 561,31 | 25 |

| 15 | Sondrio | 559,71 | 14 |

| 16 | Verona | 559,18 | -8 |

| 17 | Modena | 555,66 | 7 |

| 18 | Cagliari | 554,24 | 2 |

| 19 | Gorizia | 553,50 | 4 |

| 20 | Venice | 551,98 | -4 |

| 21 | Treviso | 549,80 | -11 |

| 22 | Brescia | 549,80 | -1 |

| 23 | Monza-Brianza | 549,62 | -9 |

| 24 | Piacenza | 549,53 | 14 |

| 25 | Pesaro-Urbino | 548,61 | 31 |

| 26 | Pordenone | 548,40 | -19 |

| 27 | Genoa | 547,84 | -1 |

| 28 | Ancona | 546,34 | 2 |

| 29 | Padua | 541,33 | 4 |

| 30 | Ravenna | 540,14 | -3 |

source: facileimmobiliare.it

How purchases are paid: Single solution or in installments?

More and more often there are offers with deferred payments and banks that grant mortgages.

By reading the announcements with some attention, it is possible to identify the age of the seller and the possibility of deferred payment.

Example

Of course, if the installment is very high then it implies that the age of the usufructuary is very high and vice versa…

It also means that the usufructuary accepts an installment payment.

source: www.casa.it

Sometimes, instead of seeing the extension, there is a discount from which the age of the usufructuary can be deducted.

source: www.libero.it

In other cases, the age of the usufructuary is clear

source: www.trovacasa.it

Advertising campaigns

Immobiliare.it

nudaproprietà.preatoni.it

How does it work in France?

How does it work in other countries?

Legal Rule and Legal Consulting

Usufruct: What is that?

The usufruct is a real right of enjoyment that allows a usufructuary to use and benefit from an asset that is owned by others with the obligation, however, not to change its economic destination and to take care of its maintenance.

The usufruct is a legal institution that allows the owner of a property to transfer the use and enjoyment of the benefits to a third party while remaining the owner.

Its regulation can be found in art. 981 of the civil code

Source: fiscomania.com

Usufruct: How is it established

- By contract: the usufruct can be established primarily by means of a contractual agreement between the parties. The contract with which the usufruct is established must be drawn up in writing, whether it is a private agreement or a public deed in the presence of a notary;

- By will. Through a testamentary disposition, the deceased person can assign the right of usufruct to another person on a single asset, or on the entire estate. The right of usufruct is not acquired automatically with the succession of an asset, but is activated following a notarial deed.

- Through usucapione

- By law: there are certain legal situations in which the law itself recognizes the existence of usufruct. Let us think of the case of the legal usufruct of the parents on the assets of the minor child.

In any case, the naked owner and the usufructuary can also organize themselves in a different way, provided that the agreement and its conditions are reported in the purchase contract stipulated with a notary.

For example, it is possible to limit the usufruct period to a certain date even if the landlord has not yet died.

Source: fiscomania.com

How long does the right of usufruct last?

The usufruct has a variable duration.

It is possible to grant the right of usufruct, of a property for residential purposes, for 10 or 20 or even 50 years. At the end, the bare owner regains the entire parental authority of the property. If no term is specified, the usufruct can also last for the entire life of the usufructuary, the usufruct rights are not passed on to the heirs.

In the case of usufruct for commercial premises (legal entity), the maximum term is 30 years.

The usufruct can be extinguished before the terms for:

- expiry of the stipulated term;

- limitation, if the right is not exercised for 20 years;

- serious abuses of the right by the usufructuary;

- merging of usufruct and bare ownership in the same person;

- perishing of the thing.

If the usufruct has been granted to more than one person, in the event of the death of one of the usufructuaries, the right is divided among the survivors if it has been specified in the deed that it is a joint usufruct. Otherwise, on the death of each usufructuary, his share will reunite with the bare ownership.

Source: fiscomania.com

Is the usufruct subject to attachment?

The usufruct is subject to attachment, but not the bare ownership, therefore, a creditor may subject the right of usufruct to attachment and subsequent auction. The buyer will be able to enjoy the asset only for the original duration of the usufruct.

Source: fiscomania.com

Transfer of Usufruct

The art. 980 of the civil code, establishes that the usufructuary can assign his right for a certain period of time or for the entire duration, in the event that this is not prohibited by the constitutive title of the right. The assignment must be subject to notification to the bare owner of the asset, until notification takes place, the usufructuary is jointly and severally obliged with the assignee towards the bare owner.

The right of usufruct can be transferred to a second usufructuary, if not excluded by the title constituted by the right of usufruct. The assignment of the usufruct to another beneficiary can only take place after transcription of a public deed or private agreement.

Source: fiscomania.com

Renunciation of Usufruct. How to do?

The holder of a usufruct can always renounce it at any time. He is therefore not forced to maintain the usufruct until it expires. However, the renunciation does not require the consent of the bare owner. The renunciation of the usufruct must be communicated to the bare owner in writing, from the moment in which the bare owner becomes aware of it, the renunciation becomes effective. This deed must be transcribed in the real estate registers. For third parties, the waiver takes effect precisely from the transcription.

The waiver of the usufruct must be total, it is not possible to maintain the usufruct only on a part of the property

Source: fiscomania.com

Selling a House with Usufruct

The bare owner of the property is the only person who can decide to sell the house.

The usufructuary cannot sell the property, but he can assign his right of usufruct which will remain active for the entire life of the first usufructuary.

The property with usufruct can be sold, but the buyer must respect the right of usufruct until expiry. The buyer who buys the property cannot use the house in the presence of the usufructu and will be able to enjoy it only if established by the usufructuary.

The difficulty of selling a house with usufruct is establishing the right price. The official tables created by the Ministry of the Economy make it possible to establish the appropriate price for bare ownership and calculate taxes.

The tables are periodically updated based on life expectancy and the bare ownership values are calculated based on the age of the owner.

Source: fiscomania.com

The: Who is?

The usufructuary can benefit from the natural fruits of the property in usufruct.

For example, the lease of the asset without altering its economic destination. Therefore, he will not be able to change his destination from residential to commercial and vice versa.

The Rights and Duties of the Usufructuary

- right of ownership: enjoy an asset in an exclusive and unlimited way

- right of residence: enjoy a property only for one’s own needs of one’s family

- right of emphyteusis: enjoy someone else’s property by paying a fee and improving the property

- right of servitude: weights and limitations placed on one estate in favor of another, once defined as a serving and dominant estate

- right of surface: to build on someone else’s land

- right of usufruct: to enjoy and derive any benefit from another person’s property

- right of use: to use someone else’s property.

The usufructuary acquires possession of the home and the right to derive every benefit from it, in compliance with the limits established by law and not to change its economic destination.

Therefore, if a property is granted in usufruct for a residential use, the usufructuary will not be able to transform the premises, assigning it to commercial use. In such a case, even the naked owner could also apply for the forfeiture of the usufruct.

The usufructuary is responsible for all taxes except property taxes.

The usufructuary can assign his right to a third party, notifying the bare owner, lease the property enjoying the fruits deriving from the rent, take out a mortgage on the home.

However, the usufructuary can assign his right of usufruct (sell it or donate it) or rent the property to other people and can also establish a mortgage on the usufruct itself. The naked owner retains the rights that are not attributed to the usufructuary. Therefore, he can sell the bare ownership of the property on which the usufruct is established without this entailing the termination of the usufruct.

As far as duties are concerned, the usufructuary must, draw up the inventory of the furniture and the description of the properties by providing a suitable guarantee, unless dispensation, use the house with the diligence of a good father of a family, bear the costs of custody, administration , ordinary maintenance and all income taxes, including rents and land rents, notify the owner of any claims by third parties on the home and return the property within the term established for the usufruct.

Following the contract, by law the usufructuary is required to take care of the ordinary maintenance of the house, which is his responsibility. The usufructuary has the obligation to keep the property in good condition, not damaging it and not modifying anything without the approval of the bare owner.

In the event of non-payment, the naked owner may make use of the usufructuary.

Source: fiscomania.com

Who pays the IMU?

The payment of the IMU is the responsibility of the usufructuary. If the latter uses the house as his first home, he is not required to pay the tax.

Source: fiscomania.com

Death of the Usufructuary

The property returns with full right to the effective owner, or to the bare owner. In this case the owner does not have to do anything except receive the property.

Source: fiscomania.com

Do the Heirs of the Usufructuary have Any Rights?

There is no usufructuary right for heirs in this regard. In any case, the heirs of the usufructuary must return the property used by the deceased to the bare owner.

This is due to the fact that total ownership of the property never belongs to the usufructuary, who can only use it or make a profit from it. The general rule is that the usufruct cannot be applied after the death of the usufructuary and therefore cannot be inherited by his heirs.

This is also valid if there are more than one usufructuary on the same property. In any case, it is the owner who holds all rights to the property even if it is in usufruct.

Source: fiscomania.com

The Bare Owner (Landlord): Who is?

Among the buyers of bare ownership there are parents for their children, but also investors who make real estate investments.

The owner who grants a house in usufruct maintains bare ownership over it, therefore, the owner of the property retains the property, but transfers possession to the usufructuary.

The naked owner can always decide to sell the property, but this deed does not extinguish the usufruct and whoever buys the house will keep the bare ownership until the usufruct expires.

Source: fiscomania.com

What are the Duties of the Bare Owner?

- Obligation to carry out extraordinary repairs where necessary. If not carried out in due time, the usufructuary can do them and demand from the bare owner the increase in value of the property.

- Respect for the right of the usufructuary: the naked owner cannot alter the form or substance of the thing in usufructuary, nor carry out acts that are harmful to the right of the usufructuary.

- Payment of the relative extraordinary expenses: The bare owner and the usufructuary must bear the various expenses for the house. The usufructuary will have to pay the utilities (water, electricity, telephone…) and the condominium expenses related to the usufruct. The naked owner, for his part, is responsible for the extraordinary expenses on the property.

- Answering the usufructuary: The bare owner must answer to the usufructuary if the property is seized or legally sold for the payment of debts.

- Pay the usufruct mortgage: if at the time the usufruct is established the property is mortgaged, the bare owner will be responsible for paying the relative installments.

- Right of ownership: the naked owner has ownership of the house even if, as we have said, he does not have the use and enjoyment of it.

- Right to sell bare ownership: it can also sell bare ownership to third parties, provided that the rights of the usufructuary are respected.

- Right to mortgage bare ownership: it is possible to apply for a mortgage loan on the bare ownership of the property in usufruct. If upon expiry of the usufruct the full ownership of the bare mortgage owner is consolidated, the mortgage also extends to the usufruct, unless otherwise agreed.

- Right to carry out works and improvements: the works and improvements can be carried out on the home of which you have bare ownership, provided that they do not cause damage to the usufructuary.

- Right to restore the use and enjoyment of the home upon expiry of the usufruct.

The Powers of the Bare Owner

- may transfer the property to third parties, without the usufruct being extinguished for this reason;

- can demand that ordinary maintenance interventions be carried out for the good conservation of the property, the usufructuary being responsible for the custody and administration of the property and the obligation to inform the bare owner about the need for repairs of an extraordinary nature. If improvements or “additions” to the property are necessary, to increase its value or simply to take care of its conservation with ordinary maintenance, the usufructuary’s negligence in carrying out the necessary repairs can legitimize the naked owner to claim the enforced execution in court with the eventual condemnation of expenses for extraordinary maintenance, which subsequently, due to this non-fulfillment, should become necessary;

- must be promptly informed by the usufructuary of the possible occurrence of harassment or usurpation caused by third parties and such as to jeopardize the property;

- in matters of leases, the usufructuary must not consent to the stipulation of a lease of the property to third parties, but, if the life-long usufruct ceases (for example due to the death of its owner), the tenant cannot continue to live in the apartment for more than 5 years from the date of extinction, unless there are subsequent agreements to that effect with the new landlord; otherwise, if a time duration has been established for the usufruct, once the exercise of the real right of enjoyment has ended, the rental relationship with the new lessor cannot last beyond the current year;

- may request restoration and compensation for damages if the same property is used for purposes other than the original ones and the structure is modified for this purpose (for example a residential apartment transformed into a commercial establishment).

- Transfer of bare ownership to the son. In some cases, a parent can choose alternative ways to leave a home to their children, without having to pay inheritance taxes. One solution may be to make a child become a bare owner, reserving the right to live in the home for life for the father and mother. To do this it is important not to make inequalities between the various children, not respecting the legitimate quotas foreseen for the inheritance. The law, in fact, imposes constraints on the assets to be left to family members, which in a certain percentage must be divided equally among the heirs, and only the residual part can be left to others voluntarily with a will. Once this aspect has been considered, making a child become a bare owner can be advantageous, as after the death of the parents, he will be able to have total and exclusive ownership of the property, without having to do anything else. Allowing others to become bare owners, while maintaining the usufruct, can also be done free of charge, i.e. as a donation, as well as through a sale. However, there is a third way, that is, the assignment behind an annuity, with which a parent binds the child to assist him morally and materially during his old age.

Source: avvocato360.it

Exceptions for the Return of Possession of the Property

- the usufructuary does not use the house for at least 20 years.

- the building undergoes partial or total destruction.

- an abuse by the usufructuary is ascertained.

Source: www.chietitoday.it

Death of the Bare Owner

Upon the death of the lessor, the property will pass to the heirs of the bare owner, but these subjects will only be able to access the bare ownership of the property, because they will still have to comply with the usufruct in progress until its established expiry from the contract.

For this reason, the death of the naked owner of a property does not entail the loss of the right of usufruct by the subject who is using it. Therefore, the heirs of the bare owner cannot request to use the property with full ownership.

The only exception concerns the prescription, which occurs when the usufructuary does not use the property for at least 20 years. In any case, it can be decided by mutual agreement to terminate the usufruct agreement early, when there is an agreement between the heirs of the deceased owner and the usufructuary.

There is also the hypothesis whereby the usufructuary subject can become the full owner of the property in question. In this case, however, a direct sale contract to the heirs of the deceased owner is required.

Source: fiscomania.com

First Home Purchase Benefits

- VAT reduction from 10% to 4% if you buy a house directly from the construction company, paying a fixed amount of 200 euros for mortgage and cadastral tax;

- a fixed mortgage and cadastral tax, i.e. 200 euros, in the case of purchases for inheritances or donations;

- To these concessions are added those provided for by the Sostegni bis decree for young people under 36 with an ISEE not exceeding 40,000 euros.

Constraints to Re-enter the Benefits of the First Home

- The purchase must relate to a non-registered residential house such as A1, A8 and A9, whatever the size of the property;

- The property must be located in the same municipality where the buyer has his residence. However, the use of the benefit is also permitted in the event that, alternatively:

- The residence is transferred to the municipality where the property is located within 18 months of making the purchase;

- The property is in any case located in the municipality in which the taxpayer carries out his activity (work, sport, study or volunteer);

- If the buyer has moved abroad for work reasons, the property is located in the municipality where the employer has its headquarters or, in any case, carries out its business;

- If the buyer is an Italian citizen who emigrated abroad, the property is his first home in the Italian territory.

Case Law: Cassazione Civile. No. 6877/2014

Bare ownership: who pays the expenses

A further advantage for the purchaser of bare ownership is represented by the fact that the obligation to fulfill the charges relating to the enjoyment of the thing (custody, ordinary maintenance, condominium expenses, etc.), remain the responsibility of the usufructuary, being the bare owner only obliged to pay extraordinary expenses.

The same Court of Cassation has further clarified that the usufructuary must provide for everything concerning the conservation and enjoyment of the thing; while the naked owner is required to bear the costs for everything concerning the structure, substance and destination of the thing.

Case Law: Cassazione Civile, sect. II, Judgment No. 9618/2014

Sales simulation

In the judgment of the simulation of the sale, relating to the size of the price, even the person who bought the bare ownership is a necessary spouse if the non-fulfillment of the payment obligation has been deduced.

source: www.maguranoimmobiliare.it

Case Law: Cassazione Civile, sect. II, Judgment No. 20788/2015

Donation

In case of donation with reserve of usufruct pursuant to art. 796 of the Civil Code, it is not possible to transfer the usufruct “mortis causa” given that it expires with the death of the holder in accordance with art. 979 of the civil code

In the different hypothesis of the legacy of usufruct, the testator has full ownership at the time of the opening of the succession, so that he can bind the usufruct, separating it from the bare ownership transmitted to another successor.

source: www.maguranoimmobiliare.it

Case Law: Cassazione Civile, sect. II, Judgment No. 22703/2015

Distribution of expenses

In terms of the division of expenses between the usufructuary and the bare owner, it is necessary to consider the nature of the interventions to be carried out, since the usufructuary is responsible and responsible for providing for everything concerning the conservation and enjoyment of the thing; while everything concerning the structure, substance and destination of the thing belongs to the naked owner.

source: www.maguranoimmobiliare.it

Case Law: Cassazione Civile, Sect. VI, Judgment No. 1506/2018

Collation obligation

The assumption of the obligation to collate, pursuant to art. 737 of the civil code, is that the person bound to it has received goods or rights as a donation from the “de cuius”, directly or indirectly through disbursements made by the latter.

It follows that, if during the life of the “deceased” the co-heir purchased the bare ownership of a property directly from the seller after this had been the subject of a preliminary sale concluded by the mother with the price paid entirely by her, at the division of the paternal inheritance there is no collation obligation in relation to that property, as the “deceased”, although he was married in legal communion with the buyer’s mother, never acquired the transferred real right to his son, nor did he make any payments for his son to buy it.

source: www.maguranoimmobiliare.it

Case Law: Cassazione Civile, sect. II, Judgment No. 4641/2018

Care and assistance clause

If the assistance and care clause, prepared in favor of the transferor and contained in the contract of sale of the bare ownership, does not have the nature of a component of the consideration by will of the parties, any failure to fulfill the obligation of assistance and care cannot give lead to termination of the contract.

source: www.maguranoimmobiliare.it

Case Law: Cassazione Civile, sect. V, order No. 18330/2021

Tenancy law

The holder of the real right of bare ownership on a building, who has the de facto availability of the asset, can grant the property on lease, and the fees agreed accordingly contribute to the quantification of his tax base, according to the general provision of which to art. 23, and then 26, of the d.P.R. no. 917 of 1986

source: www.studiocataldi.it

Case Law: Consiglio di Stato, sect. VI, Judgement No. 3391/2017

Building abuse

The typical responsibility that the building regulations provides for the ordinary (full) owner of the property right cannot fall on the naked owner since, resulting in the faculties of the dominical right in the hands of the usufructuary, only on the latter ( without prejudice to the case in which he is directly the perpetrator of the abuse) a possible culpable co-responsibility may fall for failure to dissociate, or for having failed to activate any intervention useful for the repression of the building abuse, if carried out by others.

source: www.maguranoimmobiliare.it

Codice Civile: Chapter I, of Title V of the Third Book of the Civil Code by art. 978 to art. 1026

Bare ownership and usufruct: differences

To fully define the features of the concept of “bare ownership”, it is necessary to look at a quick examination of the usufruct, the discipline of which is contained in art. 978 to art. 1026.

The usufruct is a real right of enjoyment of someone else’s thing together with the lease, the use, the right of residence, the right of surface, the right of servitude and consists in the right to enjoy the property of which you are not the owner, respecting its economic destination and receiving its fruits (art. 981 of the civil code).

It is established in the cases provided for by the law (legal usufruct), by the will of the person and cannot last beyond the life of the usufructuary, who has the right to obtain possession of the asset (in some cases after an inventory of the assets), collecting the fruits natural and civil for the entire duration of his right.

From a factual point of view, the usufructuary can assume the appearance of the owner in the eyes of the third party: he exercises possession over the thing, he can lease it, drawing the consequent economic rents, etc., but juridically he is not the owner of that asset with all the consequent limits, for example not being able to sell the asset but possibly only the right it owns, nor change the economic destination of the asset, i.e. the purpose of use and enjoyment for the same as decided by the owner.

Precisely by virtue of the fact that it constitutes an important compression of the powers connected to the right to property, however, the usufruct cannot last forever or for an indefinite period: in fact, it expires on the death of the usufructuary and cannot be valid beyond the thirty years from its establishment, if disposed in favor of a legal person (an association for example), this implying that it cannot be transmitted by the usufructuary to his heirs and, if transferred to third parties, it will in any case always extinguish upon the death of the usufructuary-assignor and not upon the death of the person who purchased it from the latter.

As anticipated, the usufruct can be established with a written contract transcribed in the Public Real Estate Registers, as part of the will with which it is stipulated that the bare ownership of one’s own property be transmitted to a person and the related right of usufruct to another subject, or it can be acquired by usucapione, if for over twenty years the subject behaves openly, continuously and with the tolerance of the owner, as if he were the usufructuary of that particular property.

Finally, it can concern movable and immovable assets, credits, debt securities, company shares or intangible assets such as, for example, intellectual property.

Finally, we speak of legal usufruct (art. 324 of the civil code) for the right of parents, exercising parental responsibility, to use and enjoy the property of the minor, until he reaches the age of majority.

The legal usufruct differs from the ordinary one due to its particular function, aimed at protecting the interests of the family: the perception of the fruits is therefore bound to the realization of family needs, the usufructuary parents can change the destination of the asset always in the interest of the minor, because, as a real right of enjoyment, it exists only in relation to the minor age of the child.

The management of the minor’s assets is subject to the supervision of the Court, therefore every administrative act to be performed must be authorized by the Tutelary Judge and any deeds detrimental to the interests of the minor can lead to the termination of the legal usufruct with the consequent appointment of a trustee (art. 334 of the civil code) for the administration of the minor’s assets until he reaches the age of majority.

source: www.altalex.com

Codice Civile: art. 1008

Does the owner of bare ownership pay taxes and duties?

The naked owner is exempt from the tax burden on the property subject to usufruct, since pursuant to art. 1008 of the civil code “the usufructuary is required, for the duration of his right, to pay the annual charges, such as taxes, fees, land rents and other burdens that weigh on the income”.

This means, for example, that the payment of the ICI is the responsibility of whoever has the availability of the asset, as the holder of a real right such as usufruct.

The IMU, TASI and IRPEF taxes are also borne by the owner of the property, i.e. pertaining to the usufructuary, the indirect taxes remaining the responsibility of the naked owner according to ordinary rates and on a reduced tax base due to the reduction of the value of the usufruct according to the tables attached to the Consolidated Law on registration tax.

At the beginning and at the end of the usufruct, the tax burdens are divided between the bare owner and the usufructuary in proportion to the right of each.

source: www.altalex.com

Codice Civile: art. 832 C.C.

How to get full ownership

The bare owner obtains full ownership of the property upon termination of the usufruct, when the powers of enjoyment and use of the property, previously exercised by another person entitled to do so, converge with their natural place in the prerogatives of fullness and exclusivity, characterizing the right of full ownership (art. 832 of the civil code).

We therefore speak of “consolidation”, when bare ownership is thus combined with the powers deriving from the exercise of usufruct in the hands of the same subject.

source: www.altalex.com

Codice Civile: Ex art. 832 C.C.

Purchase bare ownership

the owner of the property right has the right to dispose of and enjoy his property in a full and exclusive way, being therefore able to decide to obtain an income through it (so-called exchange value) by alienating it or establishing minor real rights on it (so-called jouissance realities) in favor of others.

When the property right is “compressed” by the presence of other real rights, such as the usufruct, the owner retains only the “bare ownership”, i.e. he remains the owner of his own right even though he cannot exercise the rights of use until the extinction of the themselves.

Source: www.studiocataldi.it

Codice Civile: ex artt. 978 and following ss. c.c.

The powers of the bare owner

In the hypothesis of usufruct, the holder (usufructuary) has the power to enjoy the thing and to derive every use that it can give, for the entire duration of its life, but not beyond, also being able to transfer his right for a certain time or for its entire duration, if this is not prohibited by the constitutive title, but respecting its economic destination.

Conversely, the “bare ownership” of which the owner is the owner corresponds to the property “stripped” of the right of usufruct for the entire duration of the same, in favor of its owner.

Source: www.studiocataldi.it